Market Insights

At Red Oak Financial Group, we’re excited to share our collective expertise and insights with you. Our team is dedicated to providing you with valuable financial tips, investment strategies, and industry updates. We aim to make complex financial topics accessible and engaging. Join us as we navigate the world of finance together, offering you the guidance and knowledge you need to achieve your financial goals.

A Peak Behind the Red Oak Curtain: Federal Reserve and Trump Administration Policy Analysis

Given recent events, the Red Oak Investment Committee thought it to be an opportune time to interrupt the ongoing Understanding Equities series to provide our thoughts on Federal Reserve policy and potential Trump administration policy initiatives - from an ardently market-focused perspective. This article was originally sent as an internal email to members of the Investment Committee on the morning of Thursday, 11/7/24. I hope to reinforce that 1) Red Oak is committed to understanding current events and to probabilistically forecasting a range of future economic outcomes, and 2) we will remain unbiased and objective in our economic and asset market analysis.

Understanding Equities: Economic Cycles and Equity Performance

Being able to determine where we are in the economic cycle is a necessary precondition for informed asset allocation. This article explores the cyclical nature of the economy—highlighting expansion, peak, contraction, and trough phases—and their impact on equity prices. By analyzing key indicators such as GDP, inflation, and interest rates, Red Oak Financial Group aims to refine its investment strategies.

Understanding Equities: An Overview of Stocks and Stock Markets

Equity markets are fundamental to modern capitalism, offering a dynamic platform for companies to raise capital and for investors to build wealth. Stock exchanges like the NYSE and NASDAQ facilitate transactions, connecting buyers and sellers in the financial ecosystem. Investors can engage in both primary markets, where new shares are issued, and secondary markets, where previously issued stocks are traded. Understanding these markets empowers individuals to navigate the complexities of equity ownership.

Four Ways Out of a Federal Deficit

Indebted governments have four primary ways of addressing a high debt-to-GDP ratio: default, austerity, inflation, and economic growth. Inside the article, we discuss why highly leveraged governments commonly experience diminishing returns to new debt issuance, contextualize the domestic public debt, and explore these four potentialities through the lens of a US citizen and investor.

Riding the Curve: Asset Allocation Insights from the Yield Curve

The yield curve is a useful tool to understand as a fixed income investor or economic forecaster. Key shapes include normal, inverted, and flat curves, each influencing asset allocation, risk management, and diversification in the context of a multi asset class portfolio. Yield curve analysis can aid in economic forecasting and tactical asset allocation, helping investors navigate a multitude market environments and manage risks more effectively.

The Importance of Estate Planning: Securing Your Legacy with Peace of Mind

Estate planning is essential for managing assets and healthcare decisions, ensuring your wishes are honored after death or incapacitation. It involves creating wills, medical directives, and powers of attorney. Despite concerns about costs and time, estate planning offers peace of mind and benefits, such as avoiding probate costs and legal disputes. Partnering with a financial advisor can align your financial strategy with your estate planning goals, providing comprehensive support and education throughout the process.

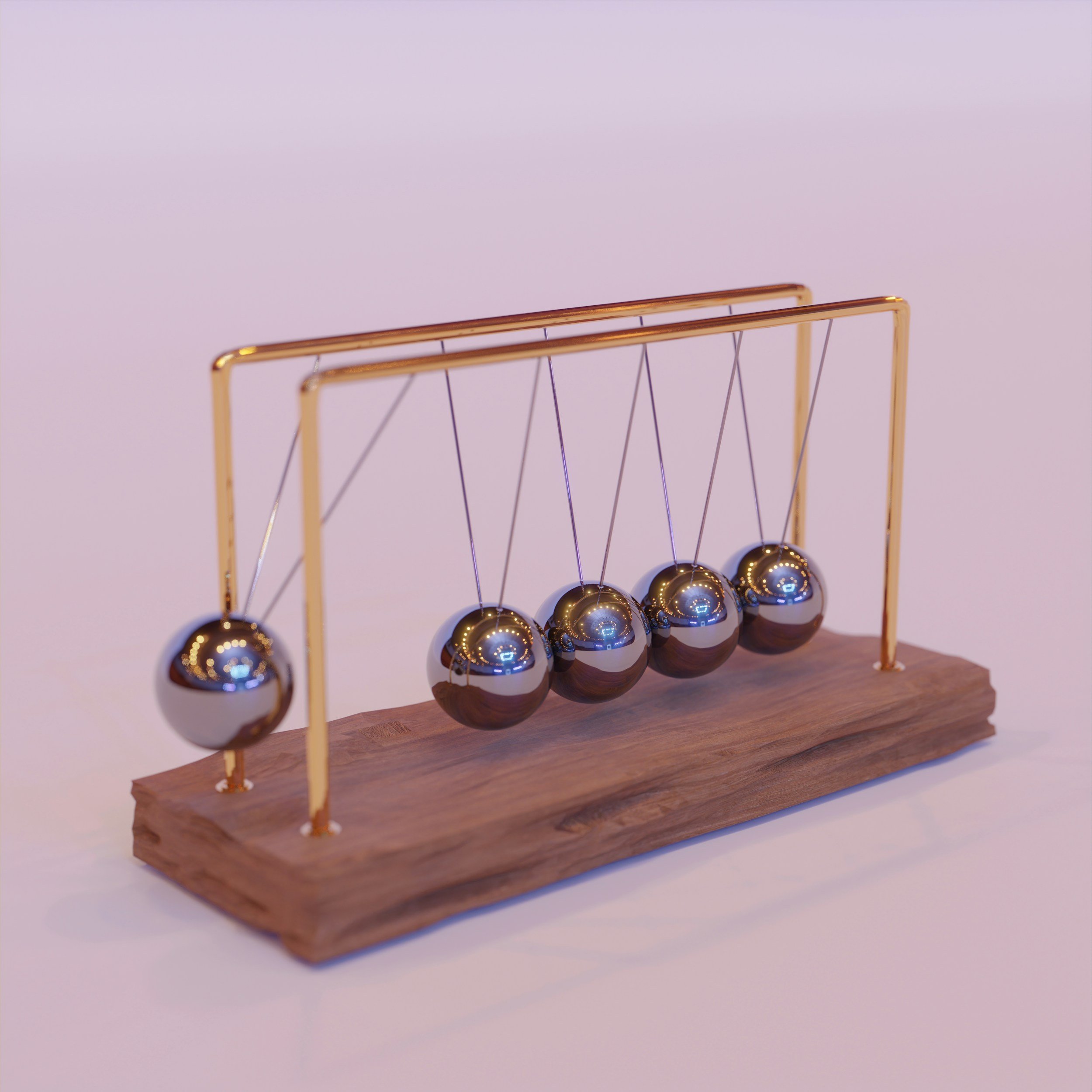

A Newton’s Cradle Analogy for Interest Rates

The article explains the influence of the Federal Reserve's Federal Funds Rate (FFR) on various bonds. The FFR directly affects only two rates, but it indirectly influences others, like US Treasurys and corporate bonds. A Newton's Cradle analogy is used to describe how bonds of different credit quality and maturity react to FFR changes. Short-term, high-quality bonds align closely with the FFR, while long-term, lower-quality bonds have a delayed, less predictable response. All bonds are part of the same system, affected by the FFR to varying degrees.

Tug of War: How Fiscal and Monetary Policy are Pulling in Opposite Directions

Inflation is the depreciation of currency value relative to goods and services. It's influenced by fiscal and monetary policies, with the former involving government spending and taxation, and the latter encompassing central bank actions like interest rate adjustments. The 1940s and 1970s serve as historical examples of fiscal and lending-driven inflations, respectively. The 2020s are marked by fiscal policy-driven inflation, with government deficits outpacing bank lending. High interest rates today may paradoxically stimulate the economy due to increased interest income for households and businesses. The Red Oak Financial Group anticipates persistent inflation, advising close monitoring of fiscal and monetary policies for asset allocation strategies.

What is the Purpose of a Good Financial Advisor?

The article emphasizes the importance of choosing a trustworthy financial advisor, highlighting that a good advisor should act as a faithful guardian of your assets, prioritizing trustworthiness and integrity. It clarifies that financial advisory is not about chasing high returns but about providing goal-based advice tailored to individual needs. Red Oak Financial Group, as an example, customizes its services to each client's unique situation, focusing on a holistic view of their financial life to help them achieve their goals. The value of a good financial advisor extends beyond investment returns to include education planning, retirement strategies, tax efficiencies, and estate planning. Ultimately, the article concludes that partnering with a good financial advisor is about building a relationship with a person, not a product.

Understanding Dividends and Dividend Irrelevance Theory

The article discusses the debate around the relevance of equity dividends, highlighting their role as a signal of financial health, historical stability, and a source of regular income for investors. It also presents the Dividend Irrelevance Theory, which argues that dividends do not affect a firm's value, and the ex-dividend date price adjustment. The piece notes the tax implications of dividends and suggests that investors should be indifferent between selling shares and using dividend income for expenses. Red Oak's asset management process focuses on total return, occasionally favoring dividend-paying stocks based on their characteristics.

Three Potential Economic Scenarios 2024

In 2024, the US and global economy face three potential paths. The Soft Landing scenario predicts moderated GDP growth, reduced inflation, and a Federal Funds Rate decrease. The Hard Landing scenario warns of a downturn and possible recession, impacting stock markets and prompting rate cuts. The No Landing scenario, less likely, suggests continued growth, low unemployment, and high consumer spending, but risks to fixed income assets if inflation persists. Investors are advised to adopt a diversified, long-term strategy with tactical adjustments to navigate these possibilities.